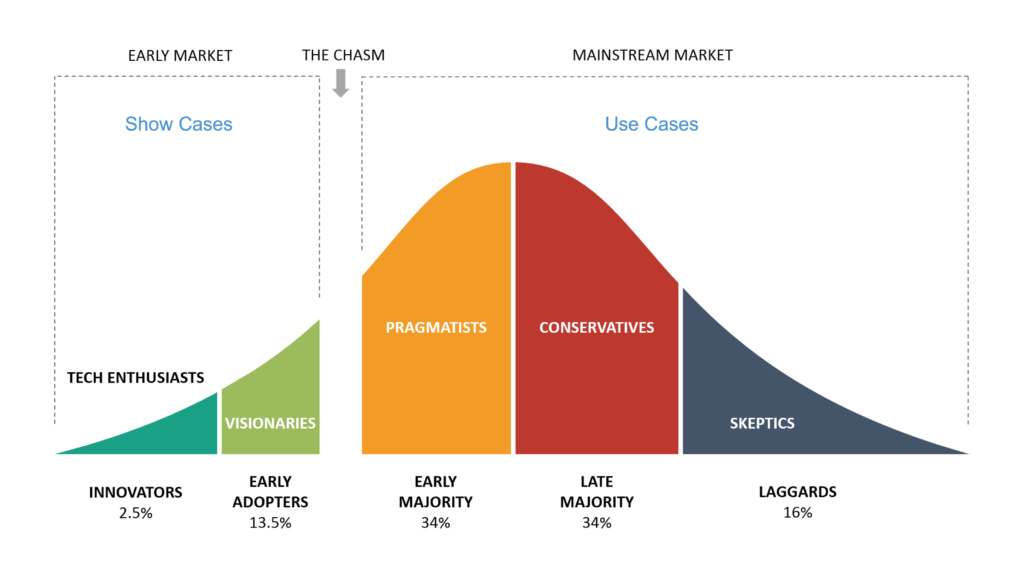

Go-to-market strategies for new technologies and categories address different audiences and change over time. Customer motivation, market maturity and knowledge level determine whether we talk about a showcase or a use case–and how to execute both.

The patterns similar: Whether it’s new categories like account-based marketing (ABM) and product-led growth (PLG), or new technologies like Augmented Reality (AR) and Internet-of-Things (IoT). It’s not trivial to run the GTM playbook successfully.

In this article, I want to show why early adopters and visionaries are looking for showcases while pragmatists buy use cases, and how it impacts the GTM strategy.

First new Logos but no Growth

Okay, this is what we often see: the product is launched, the go-to-market plan is in place, the first customers arrive. So far so good.

Next, we expect customers to grow, usage to increase, expansion to happen. The reality is: the first customers get dormant after a few weeks, the value seems not clear, customers are hesitant.

Land & Expand models get stuck in proof-of-concept, trials run out without going into paid mode. Customers bring whole lists of requirements for productive use of the product.

Why does this happen? Besides product/market fit, it is mainly the question of who we are addressing in marketing and sales. What is their motivation: show case or use case?

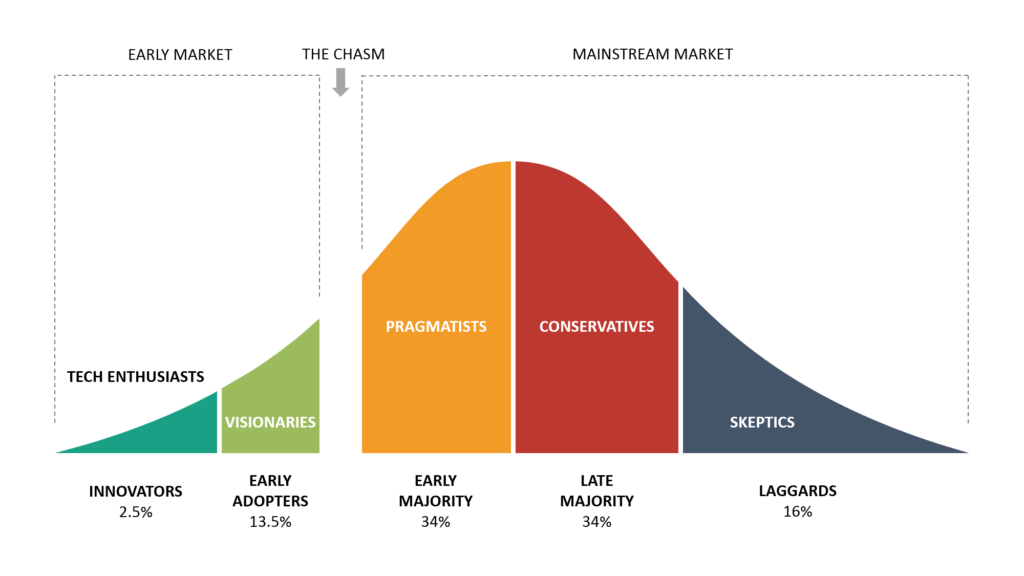

Tech Adoption Life Cycle

Here’s what often goes wrong.

We define our Ideal Customer Profile as well as the personas on the buyer and user side. We align our positioning and messaging accordingly and build the sales motion and pricing.

If we were selling a CRM system or marketing automation, we would be on the right track. Customers know what a CRM system does, it’s more about which tool is best suited for the use case.

New categories and technologies are not at this point. Here it is first about showing what problem is solved, what is different from existing categories and technologies.

A look at the Technology Adoption Life Cycle shows that buyers and users “evolve.” The expectations and requirements of the different groups are different which explains why startups see new customers but no adoption.

Early Markets

Early adopters and innovators are willing to test new technologies and categories before the masses have figured out how much value is behind them. They are already willing to take risks and invest budget to test whether the new solution can solve problems better than existing tools or approaches.

Buyers and users in the early markets are open to experimentation. They do not expect a completely finished product and pay less attention to issues required for integration or implementation in production software environments.

Early adopters and innovators are more interested in the vision and technology to give their companies a competitive advantage.

Mainstream Markets

In mainstream markets, customers expect an established product without bugs and experimentation. Pragmatists wait until the technology or category is so far developed that adoption and use is not a roulette but a given.

In mainstream markets, issues such as security, integration, reliability, roadmap and experience are critical–not only for the product but also for the team behind it. Especially for startups, this can be a hurdle compared to established players.

Decision makers in mainstream markets have different motivations to buy new solutions: financial, social or personal. They want to make workflows more productive for themselves and their teams, present themselves as innovators or build the next step on the career ladder.

The Chasm

There can be a Chasm between the two groups that must be overcome. Geoffrey Moore describes in his concept “Crossing the Chasm” the differences between the two groups in terms of what needs to be delivered. Moore’s GTM model starts on the left and grows to the right with the goal of crossing the chasm as quickly as possible.

The chasm can be smaller or larger depending on the type of innovation. The more complex the technology, the more costly to implement, the larger the chasm. It can be argued that this is especially true for discontinuous innovations compared to continous innovations.

The chasm can serve as an indicator for marketing, sales and product in which group the technology or category is located. Especially with new technologies such as AR and IoT, the chasm bears the risk of not addressing the mainstream market in time, thus losing speed and being overtaken by the competition.

Identify Show Cases and Uses Cases

Now that we know which different groups are waiting for us in marketing and sales, we naturally want to understand what each group wants.

I am a big fan of simplicity. The behavior of buyers and users–apart from our own teams–is complex enough. Simplicity may not cover all eventualities and situations, but it creates a model that is easy to use.

Show Cases

From a customer’s perspective, I understand a show case to be demonstrating the possibility and potential of a new technology or category.

This can take place in various forms:

- Proof-of-Concept

- Product trial

- Internal presentation for management

- External presentation to get customer feedback

- Marketing presentation at trade shows

- Internal analysis for feature comparison

A key feature is often that there is not yet a concrete idea of where and how the new tool will be used. In most cases, no resources for budget and teams are planned beyond the early test phase.

The purpose of the show case is to give the company and their users the opportunity to evaluate new products early. The sellers can test their product early in the market and get feedback. This is feedback from early markets, not mainstream markets. Not all feedback is the same. Relying on the requirements of early adopters can create difficulties when selling to pragmatists.

Use Cases

In the use case, we are already in the mainstream market. When I talk to customers, the expectations in this group are to implement a concrete use case:

- Solve a concrete problem

- Replace existing solution with new product

- Implement new category (e.g. build ABM team)

- Scale new technology

Typical for the use case is that the problem is known and the expected value can be measured. There is a concrete budget and team resources to introduce the new product.

The requirements on the product side are higher because pragmatic buyers expect a mature software that can be integrated into existing workflows.

In return, sellers receive valuable feedback for the product/market fit and the behavior of the users in everyday operation.

New Technology Example: Augmented Reality

The example of augmented reality as a new technology in the enterprise sector shows how important it is for the go-to-market to differentiate and understand the two markets.

AR has been finding its way into various areas along the product lifecycle for 10 years. From the design of a product, to production, to marketing, sales and service, the range is.

I have brought several AR products to market over the past few years and have had the privilege of learning from customers what the different requirements are for GTM.

How Numbers show the Reality between Show Cases and Use Cases

Early and Mainstream Markets can be shown very nicely with AR with the devices used. The numbers come from more than 100 use cases we implemented with our AR startup RE’FLEKT (acquired by PTC in February 2022).

- Early Markets: 70% of applications use smart glasses to show the potential of the technology.

- Mainstream Markets: 70% of the applications use mainstream devices (phones, tablets) to scale quickly and cost-effectively.

The goals of the two groups are different, which in the case of AR is reflected in the devices used, among other things.

Early adopters test new software and use new hardware for this purpose. Pragmatists want to use existing hardware to deploy new software quickly and scalably–without additional cost and complexity.

If you simply take the feedback and requirement from the Early Markets and use it to build the GTM plan for Mainstream Markets you will fail. The same applies to product development when it comes to which features should be developed.

New Category Example: Account-based Marketing

The different buyer and user groups exist only with innovation and new technology? No, the adoption journey can also hit new categories.

Why? Categories and technologies can be one. And in the same way that new technologies are tested, so is the evaluation of the value for new models and categories.

A few years ago, Sangram Vajre coined the term “Account-based Marketing”. “ABM” is a new software category that focuses on improving enterprise sales and marketing with more targeted measures.

ABM has also taken place before in Marketing and Sales. With CRM and Excel tables, little structured and hardly scalable and measurable. Sangram built the ABM solution Terminus, together with his co-founders.

There are now around 7,000 martech tools and it is the visionaries and early adopters who give a new category a chance, who want to find out whether they can solve tasks better.

Only later, when the hurdle has been crossed and there are enough logos on the website, do the participants from the mainstream market enter.

The chasm is not the same as with new complex technologies and is more continuous but the target group split is there as well.

Enterprise Go-to-Market – One size doesn’t fit all

Now, you might ask if the differentiation between show cases and use cases only makes sense for typical enterprise sales.

While the concept dates back to the classic top-down approach targeting buyers, it is often overlooked that the different groups also exist among users. There are user groups that want to evaluate possible solutions for their management or simply compare them. Then there are users who want to solve a specific problem, a specific task.

If you ask me, it’s important to have the different groups in mind and how they change over time. Depending on the GTM approach–whether sales-led, marketing-led, or product-led–the roles in the groups can shift.

Show Cases

Customer Expectations: The task of early adopters and visionaries is to identify new solutions and test them for their problem-solving ability. To do this, this group expects early access to technology. Missing product features or bugs are not critical for early adopters because they have the imagination to see what the finished product will look like. What is important is education so that they can act as experts in their company and in their networks.

Go-to-Market: Early adopters benefit from educational content that they can use for their own purposes. They need to be able to evaluate products and teams. This includes the vendor appearing in analyst reports and on customer review portals such as G2 or Capterra as a relevant vendor. In early markets, the focus is on technology, which is why marketing can help with technical content, tests and reviews. It also helps to give early adopters the opportunity to save their learnings in presentations.

A key difference with Pragmatists is that Early Adopters and Visionaries pay more attention to the logo than to the results when it comes to references and success stories. On the sales side, it’s important to understand that you’re selling a showcase. This can but is not automatically becoming a use case. Therefore, as part of the qualification, it is important to understand the two categories and to recognize the different “products” that are expected. The lack of understanding often leads to the typical Pilot Purgatory. The show case gets stuck in the POC or trial stage or churn rates sky rocket.

Use Cases

Customer Expectations: Pragmatic buyers and users do not tolerate bugs and unfinished products. This target group expects a working product (not perfect, but without headaches) that can be used productively for a large number of users. Pragmatists are motivated by improving workflows and simplifying work. Their goal is to make the company more successful and present measurable results.

Go-to-Market: In addition to the product side, Pragmatists want references and success stories from other companies that are successfully using the new technology and software. References from show cases from the early markets are not helpful because they do not fit the requirements of the mainstream markets. The users of the new products want to see how others use the tools.

Brand and word-of-mouth play an important role here. Users learn about new tools and how easy they are to work with in their communities. This kind of reference is much more credible than vendor content. Salesforce achieved rapid growth with this in the early 2000s as virtually the first SaaS provider. Other current examples are Sales, Slack, Miro or Firma. Twillio is an example of how customer advocacy can be built as an important component of the GTM strategy. For Sales, the mainstream market is the playground for scaling and expansion. if retention rates and customer satisfaction are right.

Crossing the Chasm

The challenge lies in mastering the leap over the chasm. This can be seen in a real chasm where software first arrives in innovation departments and then goes to the business units. Equally possible is a continuous change of the buyer and user profile if the evaluations happen more in the teams where the software is used.

Depending on the speed at which a new technology or category develops, the duration during which the GTM plan addresses two parties.

Understanding the reality behind Show Cases and Use Cases allows you to plan and execute the go-to-market in a more targeted manner. Having the two categories in mind helps to understand the different needs of your customers and what this means for your sales, marketing, product and customer success teams.

Follow me on LinkedIn and Twitter.

Dirk Schart is Director Growth & Marketing of PTC’s Vuforia suite and former CMO of the No. 1 Enterprise AR startup RE’FLEKT. He is a brand and growth leader and focuses on bringing B2B software and SaaS products to market —from zero to hero. Dirk is the former Director of SaaS Products at HyperloopTT, and helped scale SkyWork from 30 to 200+ in less than 18 months. He mentors startups at the German Accelerator in Silicon Valley and is the author of “Augmented Reality for Marketing”.